The Acceleratoin Oscillator attempts to give an early indication of momentum change, and therefore that price direction may also be about to change.

Acceleration Oscillator Formula

The Acceleration Oscillator (AC) derives its baseline from the Awesome Oscillator (AO) and is calculated by first applying a 5-period simple moving average (SMA5) to the AO signal, and then subtracting the MA value from the AO. Therefore: AC = AO-SMA5(AO) .

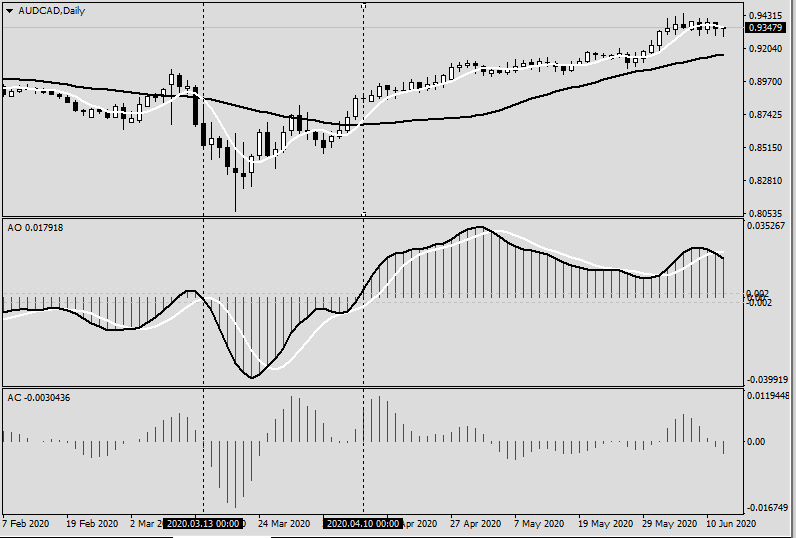

In the following chart, the middle panel shows the SMA5 (white) applied to the value of the Awesome Oscillator (black), with the Acceleration Oscillator shown in the window below it. Notice how the AC histogram is correlated with the difference between the AO and the SMA5(AO).

Acceleration Oscillator PIN Settings

Signal Mode M1, M5, etc

Allows you to independently select the filtering (Signal Mode) for each of seven time-frames: M1, M5, 15, 30, H1, H4 and D1.

Timeframe disabled (–) do not filter on this timeframe.

(D)irection. Filter based on the direction of the histogram: increasing = buy, decreasing = sell. This is the most responsive mode and may be useful for detecting a change in trend.

(P)olarity. Filter based on the polarity of the histogram: >0 = buy, <0=sell. This mode is more indicative of a confirmed trend, with consequentially more lag.

Direction and Polarity (DP). A signal is given when both Direction and Polarity agree. May be useful for detecting when a trend may be ending (e.g. Exit on signal lost).

Signal Shift:

Current Bar (dynamic). The signal is based on the current bar/candle. Since this value is changing (repainting) you may get a fluctuating signal, but this may be useful for detecting an early entry, especially when combined with the signal from shorter timeframes.

Closed Bar (confirmed). The signal is based on the last closed candle. Since this value is no longer changing the signal will not repaint, but this can mean that there is more lag in the signal.